The Friendly Banker

By Yanto Soegiarto*

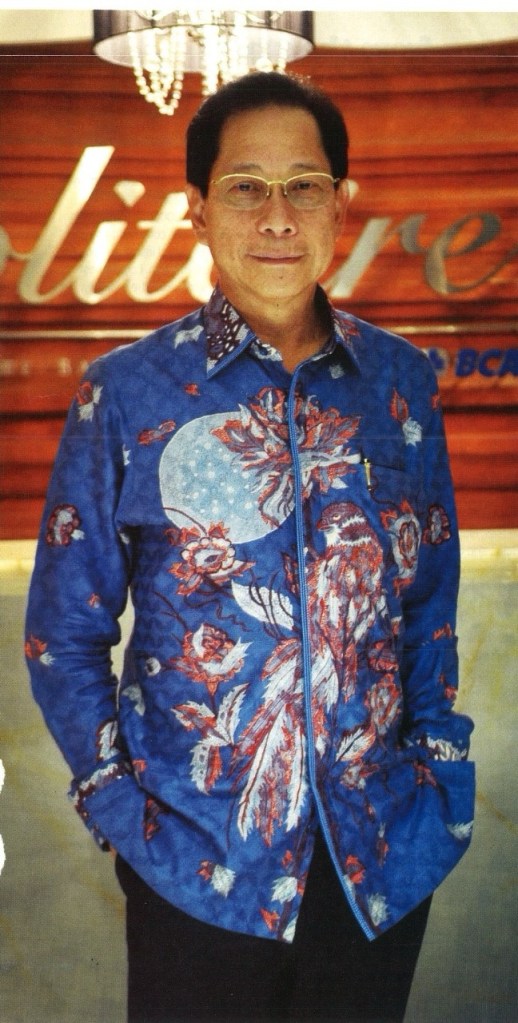

The success of PT Bank Central Asia Tbk. (BCA) in maintaining its position as Indonesia’s largest private bank can’t be separated from the role played by its president director, Jahja Setiaatmadja. During his 21 years of service at BCA, the award-winning banker has always stressed the need for good morale, humanity and friendliness in serving the public.

With a long and successful career in the banking industry behind him, 60-year-old Jahja Setiaatmadja believes that heading an organization is like being a conductor in an orchestra. He seeks harmony in the workplace in the same way that the harmony between musical instruments produces fine music. And to become a good conductor, good communication is required.

This perception and Jahja’s philosophy that service is a form of dedication have inspired his employees to transform BCA into a giant among giants in the Indonesia banking industry. A variety of prestigious awards have landed on Jahja’s shoulders in recognition of his work as head of BCA. This year he won the Lifetime Achievement Award, last year it was the Most Influential Banker award and the prize for Best CEO 2015, CEO of the Year and Most Admired СЕО.

Despite all the praise, Jahja believes the credit lies elsewhere: He attributes his success to blessings from above. “A bottom-up approach and feedback is important and so is maintaining good morale of the employees. Dedication and how to provide friendly and polite service to the public are equally important,” said Jahja during a recent public appearance.

Under Jahja, BCA is regarded as a very client-friendly bank. “My commitment is to provide convenience to the people by investing more in digital banking technology which will eventually facilitate and provide better service to the public,” he said.

An accountant who graduated from the University of Indonesia in 1974, Jahja said BСА currently has 14.6 million individual accountholders and around 150,000 corporate accountholders who rely on BCA services for transactions. “We want BCA to serve the increasing demand for transactions. This is why we continuously develop digital banking technology,” Jahja explained.

BCA’s product innovations under Jahja include myBCA, Sakuku, and Setor tarik joint deposit and withdrawal ATMs. Banking access with myBCA can be made from 10 am to 10 pm seven days a week. Sakuku is an electronic wallet catering to the young lifestyle crowd familiar with using apps on their smartphones. Joint deposit and withdrawal ATM machines enable clients to perform multiple functions on a single machine. If customers and employees are happy with Jahja, so are shareholders, most notably the Hartono family, the majority owners of the bank and the controlling Djarum Group.

Second-quarter figures at the bank were announced on July 20, with loan growth of 11.5% compared to the same period a year earlier, taking outstanding loans to Rp387 trillion – an increase of nearly Rp40 trillion. Third-party funds were up a respectable 7.8% to Rp490.6 trillion and total assets moved up 9.5% to Rp626.2 trillion. Net interest income was up a solid 15% to Rp19.8 trillion and, most importantly, net profit rose by 12.1% over the period to Rp9.576 trillion, up from Rp8.541 trillion a year earlier. Gross net performing loans grew to 1.4%, still well below Bank Indonesia’s danger level of 5%.

Jahja said in a statement that lower cost of funds was a major contributor to the results, interpreted by some analysts as being another way of saying that the bank is starting to pay depositors of saying ia less for their money as central bank benchmark rates fall. This had enabled BCA to maintain a “healthy” net interest margin, he said.

The net interest margin in fact rose to 7% from 6.6%. The results come at a time when the economy is in the doldrums. Interestingly, loan growth was most solid in the corporate sector, at 19.6%, compared to only 9.1% for consumer lending. And while the loan growth figure of 11.5% was a fraction off BI’s estimate for the sector as a whole of 12% this year, there’s still another six months to meet that figure.

BCA, Indonesia’s largest bank by market capitalization, continues to expand its business, including by developing the SME segment to complement the existing focus on corporate and consumer segments. It has set aside around Rp1.5 trillion to Rp2 trillion to acquire two small banks, although Jahja has said the acquisition process will not be realized this year.

“We are still figuring out the potential lenders.” BCA has applied to become a distributor of government-backed loans to small and micro enterprises, known as KUR. According to Jahja, the lender initially targeted to disburse up to Rp2 trillion in KUR this year, but then revised its target to Rp1 trillion due to the sluggish economy.

BCA also has plans to create a venture capital unit in the next two months. The bank is preparing to invest between Rp100 billion and Rp200 billion in the start-up incubator, which has received a permit from the Financial Services Authority (OJK). All that remains now is to decide whether the venture capital operation will be a division or a subsidiary.

At the moment the lender has seven subsidiaries: BCA Finance and CS Finance in vehicle financing; BCА Insurance and BCA Life in insurance; BCA Sekuritas, BCA Syariah and BCA Finance Limited in remittance business. ‘We want BCA to serve the increasing demand for transactions. This is why we continuously develop digital banking technology.

Success must be woven from the start

Jahja Setiaatmadja appeared on BeritaSatu TV’s CEO Talks program hosted by Primus Dorimulu, the editor of this magazine’s sister publication Investor Daily. The veteran banker revealed what it takes to be successful in serving the public.

Excerpts:

BCA is up front as one of the largest private banks in terms of assets, third-party funds, lending and market ra-party capitalization, where it is the third largest in ASEAN. What makes it so successful?

Success must be woven from the very start. Daring to invest more, provide delivery channels such as ATMS, branches. And to change the paradigm from conventional savings to savings accounts for transactions. In the past, savings accounts were just to earn a high interest rate or keep money safe under the pillow. The transformation is now that people prefer savings accounts to perform transactions as well. Loyalty no longer lies in high interest rates alone.

So how do you explain the popularity of BCA?

We were not really a pioneer but we were among the first to eye the potential of advancing through people’s savings. Branch heads questioned why we should facilitate people when it was difficult to promote savings. We believed ease of banking was the key. We provided 24-hour banking service, ATMs, internet and mobile banking. The fact now is the more people who make cash withdrawals, the more people save. We now have 14.6 million peopie individual account holders and 150,000 businessmen who bank with us.

So you attribute success to technology?

We had conventional IT to serve Astra or Indofood. But as we entered the digital era, we invested more to serve the new businesses. Now we have ticket.com, Traveloka, and GoJek. We needed to upgrade to serve the new businesses and put them in the loop. Now it is just as easy as talking to you. Last year business was disappointing.

Were you surprised?

If we flashback, true. Because CPO (crude palm oil), mining businesses and property were down. Also many workers were laid off. All these factors caused lower purchasing power. But in Q2 and Q3 of 2015 we rebounded as disbursement of the state budget took place and on the eve of Idul Fitri. We have to see it from a different perspective. We must change the way we see the condition. If we look back, it’s difficult. We must forget growth of the past. If we look sideways, we can still be optimistic. For instance in the property sector, we must not look at the number of dwellings but the supporting industries such as roofing and other building materials which are labor-intensive. What we are pushing is maintaining a decent rate for home ownership credits at least for the next five years.

How do you explain the fact that your share price remained stable despite the slower business climate?

When we listed in 2000, there were two kinds of investors, the come and go typе and the loyal type. Loyal investors look for dividends and capital gain. Loyal investors and loyal clients make up the majority. They contribute to the success of BCA.

Do you have more innovations for your customers? Yes, we have, such as Sakuku which will eventually replace our earlier Flazz product. Sakuku is an electronic wallet catering to the younger lifestyle market using apps in smartphones. It’s like a prepaid card for spending. In short e-money which will replace cash transactions for transportation, merchant trading and many others.

In your view, how should a company gear-up staff and employees to be successful?

You have to be a conductor for the right audience, the right music and the right sounds of the instruments. Recruitment for important positions should not only be conducted by the existing leadership but also have a combination of new recruits as well. We must train them. A blend of top-notch university graduates and hard workers. Loyalty is important. We need people who respect others, support each other and have a high sense of responsibility. You look at a tree. If the land is well-fertilized, the tree will grow up with strong roots, not like the bean sprout that grows instantly but dies fast. Avoid the easy-come and easy-go principle. Build strong foundations and strong principles.

Who colored your life most?

Not any particular person, it was more than one. I always try for balance in everything. Work and family life for example. On my days off, I try to get the most out of family life, with my grandson. But I also spend time with friends and golf.

+++

*About Yanto Soegiarto:

Alumnus of “Merdeka” Jalan Sangaji no. 11 Jakarta, the battle training ground for journalists. Educated abroad and trained in the US. Editorial writer on various local and international issues. Has covered many countries, including Vietnam, the former Soviet Republics, the Middle East and North Korea. Staunch advocate of freedom of expression and press freedom. Former Editor-in-chief of the Indonesian Observer newspaper, Head of Content of astaga.com, News Director of RCTI, Research Fellow at Soegeng Sarjadi Syndicate. Managing Editor at GlobeAsia Magazine, BeritaSatu Media and BBS TV Surabaya.